The present times are probably critical for more than one reason. Every generation believes that they live in unique times. At the turn of the year, when I was confident that we are heading into deflationary times, I was considered to be part of the lunatic fringe. It was conventional wisdom of the market participants that there was a less than two percent chance of a double dip recession in the USA and that the largest economy in the world would grow at more than 3.5%. Some were even forecasting 4.5% GDP growth for the USA. Seven months down the line and just two months of bad economic news seems to have made most of them run for cover. ‘Double dip’ is back in the popular lexicon and probably the topic of hushed conversations in parties (which I am sure have declined in their ostentation, though it would be sacrilege to even mention that this is a consequence of the credit crisis). It would be pertinent to ask would these deflationary pressures accentuate this year and are we heading into a collapse in the economy (like in 2008)? Once again, the answers are very tricky and by the time this note is complete I would end with more questions than answers. I will try to avoid providing empirical data as that is mostly available and there have been enough occasions where I have provided forward various news items.

On a very personal note, 2010 has unfolded more in sync with my thinking as elucidated in my period updates about the economy. Despite all the pessimism about the economies of the Western World, I am bit more optimistic than the most recent ardent bulls turned confused-bulls. But that could probably be due to the fact that I have been so bearish for such a long time that it may feel like up to me. However, I am outright bearish on the real economies of India and China. This is not to mean that I expect both of them to collapse. Unfortunately for both these countries they don’t have to have a recession before their people feel like a recession. In the case of India, the Ministry of Labour estimates that nearly 20 million people will join the work force from 2010-15, therefore unless the economy grows at more than 6% the country will face greater problems. Similar problems exist in India. Thus most of the emerging markets have to run faster just to remain at the same place. Is that possible? Theoretically possible, practically a herculean task. I would be watching China very closely, not because I believe like the rest of the crowd because it could lead us out of the mess, but because it would probably be the answer to the question: are we heading into a depression?

It was conventional belief (at least for me) that one year was a short-time when it comes to the working of the real economy (not the financial markets). The markets as well as the economy have literally been on a roller coaster over the past two years and probably continue to be so over the next five years (a validation of the Japan chart that I had sent about a year ago). As a researcher what interests me is the tussle we have among the bulls and the bears. These usually occur either at market tops or market bottoms. Reading the Indian newspapers gives me the eerie feeling that it is 2008 Déjà vu allover again. We have estimates that the Sensex will reach 22,000 over the next few months, new range bound Sensex: 17000 to 22600 (I wonder how they could conjure up the 22,600: probably a technical target). The list goes on. In other words, anybody dissenter is senile (at best) or positively mad (at worst). I often wonder which category I fall into.

Unconventionally, I will start with the good news. The Credit Spreads have settled down from their panic that was indicated in their late April surge which caught most of the people unawares (not us by the way). However, this is not to claim that the panic is over. The decline in the credit spreads may simply mean a breather, just as we had in 2008. Moroever, with the stress tests due on 23 July 2010, the celebrations may be too premature.

What I am probably more excited (again, may be too premature) is the Helicopter Ben is now more amenable to increasing the money supply. The last two weeks have been critical as after a long time, the Fed has increased not only stopped draining money from the system, but has instead marginally increased it. Since Bernanke is a scholar (and an excellent one, unlike Greenspan) of the Great Depression, he may be able to stave it off – but only this one time.

Another piece of good news is that unlikely 2008, the US and the Japanese corporate sector has cash on its balance sheet, implying that their survival is not at stake over the next one year, unless something goes wrong horribly. I am beginning to wonder why companies were not willing to spend for such a long time? Probably, they have stopped believing the Equity markets and instead prefer to hoard cash. Take the case of the banks. They prefer to buy US Treasuries.

An analyst had a great idea: the banks should be forced to lend and that way they will put money back into the system. He also accused the Fed of not doing enough and instead claimed that the Fed was encouraging the banks not to lend as it was paying an interest on the funds parked by banks with the Fed. I would not be so critical of the Fed and would instead think that the analyst suffers from intellectual poverty. I think if there is any institution that knows the scale and magnitude of the problems, it is the US Fed. They are trying their best to let the banks earn their way back to profits so that they it reduces the need for more bailout funds, which may not be so easy to come by.

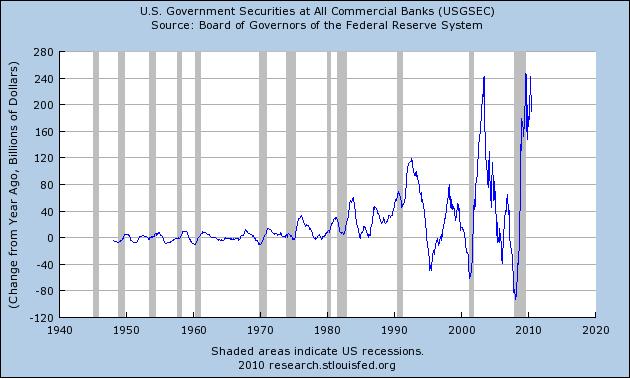

The following chart (non US Government securities investments) clearly shows that the balance sheets of the banks continue to be stressed). They are not investing and are instead still busy rectifying their balance sheets. This is probably because their capital hole is too big to be filled in a short-time. A recent New York Times article stated that the banks worldwide need to repay bonds and other debt obligations to the tune of about US$5 trillions of debt due through 2012.

Hence, their unwillingness to invest in any assets, expect the most liquid asset (the US Treasury bond) after the collapse of the securitization market augurs ill for the world economy.

The chart below provides an overview of the US Government securities owned by Commercial banks in USA. While that could provide some capital cushion in the short-term, I believe that in the long-term that is insufficient for the simple reason that the bad loans on the books far exceed their assets. David Rosenberg has pointed out that the US banks have a second-lien exposure on housing mortgages to the tune of nearly US$850 billion. These assets are marked at par by value in their books, surprisingly high considering that housing is on the verge of another sharp downmove.

Consumer credit continues to collapse on a scale that is similar to the levels not seen since the Great Depression. The chart below shows the magnitude of the debt deleveraging that the US is

is passing through.

Double Dip or Continuation of the Recession

The dating of the recessions (officially) at least in the USA is the task of the Business Council Dating Committee of the National Bureau of Economic Research (NBER). To the best of my knowledge, they have not called an official end to this recession as yet, though they may announce it by back dating it. So officially the USA is still in one. I am sure nearly 18 million partly employed or unemployed may actually feel it is more akin to a Depression rather than a recession. Interestingly, even the perma-bears are not willing to call a double-dip. A number of them actually believe it could be more like 2002 when we have a relapse but would actually avoid recover from the edge of the cliff. Unlike, 2002, the government’s (not just in USA, but all round the world) have less maneuvering space. Instead, the next phase of the panic is likely to be trigged by a government related issue.

I would be less sanguine and have a slightly different hypothesis, which I am now more inclined to believe. I believe there are a lot of factors that could go wrong. I would prefer to look at the economy and its possibilities of a recovery through the third angle, rather than in simple binaries: recovery or collapse in the near term. It is very likely we are heading into a period of periodic storms followed by huge rallies that would be due to technically oversold conditions that may be accompanied by bouts of misplaced optimism that the economy is about to recover.

What makes me so bearish? Top on the list is the fact that the world has not solved any of the problems that led us into this mess in the first place. The crisis has basically made the consumption driven model of the past 35 years for the world economy, atop which our process of globalization was built more or less redundant. It based on a few consuming nations being supplied by low cost countries providing the goods and services – first Japan, followed by the South East Asian countries and now China: remember the flying geese pattern hypothesis for the world economy. This model could have become more sustainable if at each stage nations moved into a higher plane of economic activity, like providing high ended services while at the same time transforming their labour force to suit the needs. But that would have needed rapid technological breakthroughs at an interval of one a decade. Unfortunately, the history of technological change is that we usually have major technological breakthroughs taking place at a three decade interval. The shaky economic model would probably have been punctured by the turn of the last decade of last century, but the rise of the internet postponed matters, albeit for another few years. In the interregnum, in order to deal with cyclical problems that arose due to a down move in the business cycle our policy makers created ever larger bubbles in different sectors. While this story is well known and is oft repeated, the post 2008 reaction of the policy makers, especially in the past two years is shocking.

Obama’s attempts to solve some of the problems created by the financialisation have been shot down by his opponents. The mild measures that he had proposed were further watered down and it now unlikely that they will make any difference in taming the speculators round the world. Thus, the structural problems that the world faces have not only grown worse. We have not able solve any of the structural problems that have been brought to the forefront due to a redundant world economic developmental problem have not been dealt with. Instead the policy makers are attempting to solve the issue of indebtedness by taking on more debt. In the past we had a few institutions that were ‘too big to fail’. This list has now morphed into ‘exponentially large to fail’.

Welcome to the Era of Rotating Sovereign Crisis:

The downward spiral in the world economy, albeit at deterioration at varying speeds and intensity, has led to a common mistake, especially amongst the laity. They now mistake the crisis as a mere cyclical problem in a structural story that is intact rather than the other way round. The remarkable, lasting legacy of the crisis has been complacency or more like selective amnesia that pervades once there is rally in the markets. A recent article implied that a 8% rally in the Euro may mean that the Europe had already passed its biggest stress test. The ostensible reason for thinking seems to be that Greece, Spain and Portugal had raised about 50 billion Euros in debt, since the EU announced their US$1 trillion rescue fund. Investors may be better advised to note that the ECB has actually purchased bonds in excess of Euro 50 billion since the rescue package implying that foreign institutional investors may be keen to exit the Eurozone. All the three Club-Med countries (as PIIGS) are now referred to), have seen their interest costs shoot up by at least a percent. Greece borrows at more 10% for their 10 year bonds, while Germany borrows at 2.61%. At the beginning of the year, it was more like 6 and 3.5% respectively. More ominously, since March, none of the Southern European banks have been able to access the bond markets. Ironic, that we have so many ardent bulls even at this stage. Policy makers are indulging in pep talk rather in order to reduce the panic. They probably forget to that a problem exists not just in Southern Europe but also Eastern Europe.

We are yet to see the full fledged impact of most of the governments cutting spending in order to please the bond market. The bond market has already got what it wanted, reduced government spending means that the last vestiges of factors that may cause inflation are wiped out. All the indicators seem to indicate a fall in demand and collapse in pricing power. The question that we have to see is if we are about to witness a gradual decline or a precipitous fall. I would think that we are about to see a slow steady creeping in deflation over the next few years. I am wrong: we are not going to witness into a deflationary spiral this year. That is why I dread this type of collapse, a precipitous fall will also create the momentum for a rebound. A slow grinding fall would mean that it would be more difficult to combat inflation, more so because one part of the world (Emerging Markets) are grappling with their last bouts of inflationary spiral. The lag-effect is probably what we are witnessing. Producer prices continue to fall over a quarterly basis, loan demand has collapse (see Japan if you don’t believe me: down for five quarters), unemployment continues to grow, personal incomes are down, retailer have continued to see a collapse in margins: they now expanding the items available for discount.

There are other problems the US economy is undoubtedly slowing and it may tip over if there is no additional short-term stimulus. The economy has declined from about 5% in the last quarter of last year to about 2.7% last quarter (after downward revision). Interestingly, it has been pointed out that about 1.88% of the growth was due to inventory restocking, a process that is now not taking place. Thus we are likely to witness greater pressures on the economy, apart from the consumer, which comprises of about 70% of the economy. Add to this the problem that debt has not declined in the US and continues to be more than 120 percent (relative to disposable incomes). This is bound to rise as personal incomes decline in the country.

Positive views about European economies are largely a result of rear view mirror driving. The problems of Europe are just starting and they are likely to bite with greater intensity only in the next four quarters. Hungary has been through fiscal austerity since 2006 but has not been able to recover. Ireland is yet another case of what happens when we crash into a deflationary spiral – especially when the policy makers do not have any more effective tools.

Most of the Government’s desperately need money in order to repay their maturing debts. They face Hobson’s choice of whether to default on their debt obligations (which would be immediate death warrant) or take up draconian expenditure cuts and increased taxation while retrenching thousand or probably tens of thousands. The second set of measures would be political suicide and a recipe for social unrest, which is yet to start. There is a limit to the tolerance of those who suffer, especially when they are witness to the excess pay of the bankers and others whom they would view as being let off loosely. England would probably be the case that we would have to watch closely for clues about how this would play out. The government has vowed to reduce expenditure and they have imposed taxes in the budget that would force each household to pay at least 3000 pounds in either direct or indirect taxes – the largest squeeze since the 1970s. While till date these measures have been received with muted opposition due to the goodwill that exists for any new incoming government, it would probably be difficult to sustain further cuts and new taxes.

Optimism about a likely sustenance of economic momentum is likely to be dissolve quickly as the increased activity that we saw in the form of recovery of European exports are not due to increased demand but because they have turned out more competitive in the market place due to the collapse in the currency. Therefore it is likely that this short-term measure is likely to have resulted in EU companies having outbid their Chinese and US rivals, meaning that as long as demand is unlikely to pick up, European rebound is likely to be a zero sum game.

The only tool that the policy makers have is their ability to increase the supply of money. Bank of England and the US Federal Reserve are largely gearing up for this. The steep fall in the money supply (see chart) means that the impact of this will be felt over the next couple of months. We believe that the fall in the housing in the USA with additional signs of growth cooling in China will provide the trigger for the next step of easing from the US Fed.

However, we should not read too much into the intentions of the US Fed and the Bank of England to increase the money supply. The sheer magnitude of the requirements in order to simply rollover maturing debt would far exceed the increased supply of money. Banks in Europe need to rollover or repay nearly US$5 2.6 trillion of liabilities in the next three years, while banks in the USA need to refinance US$1.3 trillion through 2012.

Banks worldwide owe nearly $5 trillion to bondholders and other creditors that will come due through 2012, according to estimates by the Bank for International Settlements. About $2.6 trillion of the liabilities are in Europe. Bank of England has clearly stated that that the funding gap for the British banks would be a "substantial challenge" and points out that the amount that UK banks need to refinance by the end of 2012 at between £750bn and £800bn . Add to this the colossal sovereign and corporate debt and we will easily cross US$12 trillion. The inflation hawks fell allover themselves when the governments pumped in US$3 trillion or thereabouts. Imagine their reaction once the governments are forced to keep the money flowing. Unfortunately, this money needs to be created at a time when the world economies are cooling. Brazil has just been added to the long list of countries that are likely to witness a cooling of growth. Thus the fond hope of the optimists that the Emerging markets are likely to spearhead the world economic growth may not fructify. As long as the slowdown does not result in hard landing in the world economy, we may remain hopeful that the world economy may limp its way in circles.

There are a number of other indicators that are indicating that the world economy (and with it invariably the markets) are heading into unchartered waters. Among the indicators that need to be specially watched include:

(a) Baltic Dry index which has collapsed over the past two months. It is imperative to note that despite recent moves to dismiss the indicator, its direction has precedes the equity markets by about 3-4 months. Optimists should pray that it is wrong (at least this time. If the indicator were to be proved right then we could expect a precipitous fall in the equity markets in the next three months. From a purely technical point of view, the indicator will be able to avoid a new low only if it is able to sustain above 1500 (the close on 21st July 2010 was 1781). (b) The Journal of Commerce Smoothed Average is yet another reliable indicator that is indicating trouble. The indicator consists of commodities that are exchange traded as well as those that are traded between actual users and those which donot have the presence of the financial speculators. The only other time that the index has crashed with such intensity was in the months before and after Lehman – a portent indicator of a sharp slowdown in the economic activity. I would speculate that Companies may be so weary that they may actually be shutting down capacity, which will be bad for the economy over the next two quarters but inventory restocking will simply lead to another bout of recovery in the manufacturing sector from March 2011.

Directional Call on the World Economy: Recovery or Deflation

Though over the next 2-3 year period I am more inclined to believe that deflation will be the predominant stress factor over the World economy, it will not take the centre stage during the rest of this year and early next year. However, the deflation scare will continue to become more pronounced (I hope I am not considered to be part of the lunatic fringe for this). My reasoning is rather simple. Bernanke had pointed out that the Fed can expand its balance sheet upto US$5 trillion without causing major strain in the public finances. Their balance sheet is under US$2 trillion. This would imply that while it could increase its balance sheet by another US$3 trillion, I believe it could reach another US$1 trillion in case of special circumstances, where the predominant fear would turn to economic growth rather than the present sovereign debt issues. That expansion in the balance sheet may be the catalyst that could avoid a deflation this year. But I am not so sure it would avoid it in the long run as the law of diminishing returns is far too advanced for the US to use further stimulus to create further growth. The ability to create GDP growth by pumping further stimulus has dramatically declined over the past few years. Moreover monetary policy takes time before its impact feeds into the system.

I place the possibility of a sustained recovery very low. However this is not to mean that the world economy will collapse. Instead I think the world economy is set for a prolonged phase of gradual decline (remember Japan) over the next few years with a period jumps that would largely be part of a cyclical upmove within a broader down turn. We have seen how long it could take (Japan) if there is no war (as in the case of the Second World War) to bring the economy from this self-perpetuating downward spiral.

Fleet footed, well-informed investors could benefit vastly over the next few years provided they raise that

(a) Opportunities will be global in nature.

(b) Capital would play a increasingly important role.

(c) Precise knowledge and analytical skills are required to rotate into and out of sectors.

(d) They realize that the new long-term would 2-3 months or at most 5 months.

(e) Markets would be driven by technical and news flow rather than fundamental in our new long-term.

As always, I hope my analysis is wrong as it would be far easy to earn money in a market that is uni-directional rather than what I expect.