Business of Rare Earth Elements: Super Cycle or Bubble?

Rare earth elements (or rare earth minerals) have been in the news over the past few months for a variety of reasons, the most important being the fear that China (the largest producer and exporter in the world) is curtailing the supply of these minerals for geopolitical reasons. This reason has led to a big rise in the stock prices of these resource producers in the global equity markets. The controversy surrounding the Chinese has also led to growing attention being focussed on a segment which hitherto was part of the debate of only those in the mining sector and the investment community attached to it. The spill over of the debate into the public domain seems to have created an unnecessary hysteria about the non-availability of the resource for posterity. A natural corollary of this has been that the stock prices of these companies have jumped manifold, mostly in a matter of four months.

What are Rare Earth Elements?

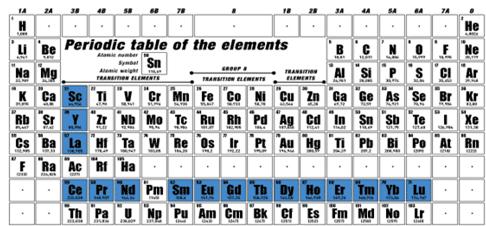

Rare earth elements (henceforth REE) or rare earth metals are a collection of 17 chemical elements in the periodic that comprise of Scandium, Yttrium and 15 other lanthanides. Most of them have similar chemical properties and are mostly found in similar deposits. Rare earths were first found in 1787 with the discovery of Ytterbite (since renamed to Gadolinite in 1800) by Carl Axel Arrhenius in the village of Ytterby, Sweden. REE have gained an increased importance due to technological change has meant that there is now an ever growing need for Rare Earth Elements (henceforth REE) in different spheres.

Their importance stems from the fact they are compulsory ingredient in the manufacture of most high-technology products, nuclear industry, petroleum sector and other sectors so vital to the economy. They cannot be easily substituted. Their magnetic and other important properties means that they find application in electric motors, mobile phones, laptops, automobiles, electric and hybrid vehicles, batteries, missile systems, satellites and communications systems among others.

Given below is a periodic table and classification of each element.

“Rare” earth elements are in actuality not as rare as their classification seems to imply. The reason for the name has more to do with the unfamiliarity rather than actual rarity. They are considered to rare largely because they are not found in similar concentrations or individual abundance as those other industrial metals like copper, tin or lead. Some of them (Thulium and Lutetium) are nearly 200 times more common than gold.

Given below is a table that lists the 17 rare earth elements with a brief mention about some of the more important usage. It is important to note that some of the elements draw their name from either the scientists or their geographic area of discovery.

| Name | Atomic Symbol | Symbol | Importance/Usage |

| Scandium | 21 | Sc | Aluminum Scandium Alloy |

| Yttrium | 39 | Y | High Temp super conductors, Garnet. Low heat sensitivity |

| Lanthanum | 57 | La | High refractive index glass, oil industry, battery electrodes |

| Cerium | 58 | Ce | Chemical Oxidizing agent |

| Praseodymium | 59 | Pr | RE magnets, lasers, glass and ceramics among others |

| Neodymium | 60 | Nd | RE magnets and lasers among others |

| Promethium | 61 | Pm | Nuclear Batteries |

| Samarium | 62 | Sm | RE magnets, lasers neutron capture & devices producing coherent electromagnetic waves |

| Europium | 63 | Eu | Lasers, mercury vapour lamps, etc |

| Gadolinium | 64 | Gd | RE magnets, garnets, lasers, X-ray tubes, computer memory, etc. |

| Terbium | 65 | Tb | Lasers, fluorescent lamps, etc |

| Dysprosium | 66 | Dy | RE Magnets and Lasers |

| Holmium | 67 | Ho | Lasers |

| Erbium | 68 | Er | Lasers & vanadium steel |

| Thulium | 69 | Tm | X-ray machines |

| Ytterbium | 70 | Yb | Infrared lasers, chemical reducing agent, etc |

| Lutetium | 71 | Lu | Very rare. Because of rarity and high price stable Lu used in Nuclear technology and petroleum |

Complied from different sources

Some of the common properties of rare earth elements include:

- The rare earths are silver, silvery-white, or gray metals.

- The metals have a high luster, but tarnish readily in air.

- The metals have high electrical conductivity.

- The rare earths share many common properties. This makes them difficult to separate or even distinguish from each other.

- There are very small differences in solubility and complex formation between the rare earths.

- Rare earths are found together, often in combination with other rare earth elements.

- Rare earths are found with non-metals, usually in the 3+ oxidation state.

The significance of REE is that they are not found in significant concentrations and their geochemical properties make them difficult to find in economically exploitable ore deposits that would make them viable to be commercially exploited. They are often found in concentrations that are mostly in combination in other elements thereby making their isolation difficult and costly. The case of Lutetium is illustrative of the nature of REE: it is considered to be one of the rarest of the rare earth elements. It is never found by itself but is found with almost all of the other REE. However, since it is very difficult to separate from others, it is very expensive. Only about 10 tonnes of Lutetium are stated to be produced annually and the cost of the metal exceeds US$10,000 per kilogramme

Economic Importance of Rare Earths

The importance of the REE stems from nature of the technological advancement of the human race and the growing importance that is currently attached to miniaturisation of electronic times and the need for devices to fulfil an ever growing need array of functions. Their added importance stems from the fact that REEs have widespread application in highly advanced military and telecommunication systems. The usage of REE has been increasing in different applications over the years. Hybrid car, Prius contains about 10 kilograms of rare earth, while a typical 3 megawatt wind turbine requires nearly one tonne of Neodymium Iron Boron Magnets.

On the other hand a MRI machine requires the use of about 185 kilogrammes of different rare earth elements. The US uses nearly 75 kilogrammes of Rare Earth elements daily in their petroleum refining process.

This has led to an added urgency for various national governments to an active interest in maintaining a stead supply of the minerals.

The availability of rare earth minerals is concentrated in only a few geographies. The reserves are mainly concentrated in China (36% of the total known reserves), USA (13% of known reserves), Russia (19%), Australia (5.4%), India (3.1%) and many other countries including Brazil, Malaysia and Sri Lanka ( Rare Earth Elements: The Global Supply Chain, Congressional Research Service, p.6.). The major suppliers of REE to the world economy are China (120,000 metric tonnes or 97%), India (2700 tonnes or 2%) which are followed by the rest of the countries. The total supply of REE in 2009 amounted to about 124,000 tonnes.

Till the beginning of the 1990s, USA was one of the largest suppliers of REE, but it has since been overtaken by China, which now accounts for nearly 97% of the current world production and supply. Japan consumes nearly 20% of the REEs exported by China with Europe and USA accounting for the balance consumption. China’s reserves and production are largely concentrated in the Tibet, Inner Mongolia region and Southern China. The Chart below provides an overview of the global production of Rare Earth Oxides from 1950-2000.

Issues in Rare Earth Elements Supply:

Despite the availability of REE in nature, their supply has declined substantially over the past two decades. The causes for this decline are largely due to the confluence of three reasons: (1) China’s attempt to gain market leadership in REE supply by driving down prices, (2) Increased environmental awareness and (3) a General Commodity decline that lasted from the mid 1980s to 2001. The most important factor was China’s attempt to gain market dominance, where it directly subsidised producers and turned a blind eye to the environmental impact. Till about the mid 1980s, USA was the largest supplier of REE. By the mid 1990s massive state subsidies led to Chinese producers under-cutting the price vis-a-vis other producers. This combined with lax environmental regulations and enforcement in China enabled it to emerge as the largest supplier of REEs while most of the other companies/countries either went bankrupt or decided to discontinue production. India was one of those countries that discontinued most of its production in 2004 due to the uneconomic prices in the global market.

The market dynamics have undergone a change since 2008, when China started imposing export quotes on REE supplies. China has also set a production cap of 89,200 metric tonnes in 2010. It has determined export quotas in 2010 at 30,000 metric tonnes, about 18,000 tonnes less than 2009. The supply of rare earth elements became an issue after Japanese and other Western media claimed that China had halted supply of rare earth elements after geopolitical tensions in the South China Seas. China however, denies that there are political motives involved in the issue. It claims that it is interested in not only preserving the cost of the rare earth resources but more importantly, it wants to curb the disastrous consequences of the environmental impact of decades of rare earth mining. There is undoubtedly a semblance of truth in this with nearly half of the global supply of rare earths coming from a single iron ore mine in north of Baotou. However, the nature of the Chinese state and China’s politics means that one is never sure whether a particular decision has a pure economic rationale or whether the political motive is part of the package.

The interesting aspect of China’s policy towards rare earths has been that it is aimed largely at the supply of rare earth material in its unprocessed form. There are no curbs for those exporting value added items. This raises serious questions about China’s policy, which seems to be a clear policy aimed at supporting its exports move up the value chain. China also seems to be more interested in laying its hands on high technology that may go with the export of items in its value chain. By reducing the supply of unprocessed REE China seems be intent on forcing manufacturers to relocate their high technology manufacturing into China. The Japanese are the largest importers of China’s REE. Most of Japan’s high technology items are manufactured in Japan, which they are not keen at present. Manufactures like TDK believe that their closely guarded high technology techniques should remain a closely guarded secret. Most of the advanced stage manufacturing continues to be based in Japan. China hopes that if the Japanese high technology manufactures are forced to relocate their units, it would be beneficial to their country in the long-run – a process that has already begun in the case of some industries.

China’s strategy of forcing the issue could backfire over the long-run. The Most important reason why REE are critical is not because of the lack of their availability. Instead it has more to do with the fact that because of their similar chemical properties, rare earths tend to be available in different blocks and it is a costly process to extract, separate and refine them. They require exponentially large quantities of water, acid and electricity. The residual waste that is often toxic and radioactive, thereby increasing the cost of production. It has been pointed out that the production of one tone of some REEs requires nearly 850 gallons of water and often produces in excess of nearly 2000 tonnes of waste that is generally difficult to dispose.

As the demand for REE and the prices increase (much of it due to Chinese policy and a general rising demand for commodities), a large number of producers which had to shut down capacities will find it more economical to reopen their facilities – a trend that is already underway. India is one such example, which has decided to not only reopen and reinvest in existing capacities but has also started to call for expression of interest to start new ventures. The Indian state of Karnataka is stated to have evinced interest in granting mining permits for those interested in REE. As the clamour for REE increases, national governments are bound to relax the stringent environmental norms – after all there is nothing provides a more compulsive logic than national security.

However, investing in companies/businesses/ETFs that are enable investors to gain an exposure in Rare Earth Elements may prove to be compulsive business logic over the next four to seven years. The investment logic arises due to a number of reasons. The commodity boom is expected to continue for a few more years due to the debasement of the fiat currencies the world over. The companies that produce REE will continue to have excellent pricing power over most of the next decade (unless there is another repeat of late 2008 conditions) largely due to the growing demand for a growing array of smart devices/instruments/applications.

Investors (not entrepreneurs) may be well advised to maintain caution over the short term (6-12 months perspective) due to the exponential jump stock prices in most of the companies (at a global level) that produce REE. Most of the companies have seen prices jump between 100-500 percent since July 2010. Investors desirous of an exposure, albeit more risky structural bet, may consider an exposure to Rare Earth Elements Market Vectors Rare Earth Exchange Traded fund in USA (Symbol: REMX) on declines. There are no listed REE companies, and the first off the block always has a unique advantage. The largest producer of Rare Earth Elements in India is the public sector Indian Rare Earths Limited, it remains to be seen if the government will list the company over the next three years.

No comments:

Post a Comment